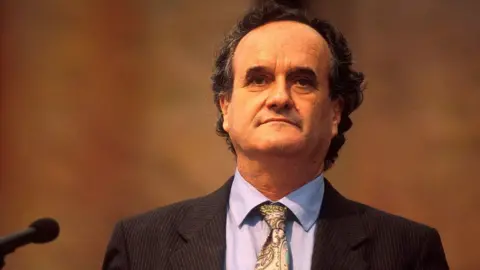

India's Finance Minister Nirmala Sitharaman has presented her annual budget for 2026-27, announcing higher infrastructure spending and measures to support domestic manufacturing amid rising global uncertainties.

India is expected to close this financial year with 7.4% gross domestic product (GDP) growth according to the country's Economic Survey, but economic expansion will slow slightly next year as tariffs from US policies begin to exert a greater impact on Indian exporters.

This budget emphasizes fiscal restraint, targeting a lower deficit for the upcoming financial year. The fiscal deficit, which is the gap between the government's total expenditure and total revenue, is a focal point of the budgetary metrics.

Record infrastructure spending, higher defence outlays

Infrastructure projects have been a sustained focus of the Narendra Modi government, and this budget continues to prioritize spending in these sectors. The capital spending target for the new financial year has increased by 9% to 12.2 trillion rupees ($133.1 billion), with significant hikes to defence budgets in response to global security challenges.

Manufacturing push in strategic sectors like rare earths, semiconductors

To bolster domestic manufacturing, the government aims to develop seven strategic sectors, including semiconductors and rare metals. Dedicated transport corridors for rare earth minerals will be established across several Indian states to streamline production.

The budget allocates $436 million for India's second semiconductor mission, enhancing local capabilities for technology and manufacturing essential components.

In addition, tax incentives for foreign cloud companies investing in Indian data centers aim to bolster the country's global tech presence.

No new tax giveaways

While the budget raises limits on duty-free inputs for key export industries, no personal income tax cuts were implemented. This follows the government's previous tax changes that optimized existing revenue streams.

Fiscal restraint

The government has shifted its focus to an overall debt-to-GDP ratio, aiming to reduce it from 56% to 50% by 2030. This strategic adjustment seeks to enhance fiscal flexibility while maintaining a focus on capital expenditures.

Markets disappointed

Despite fiscal discipline indicators, markets responded unfavorably, largely due to an increase in Securities Transaction Tax on futures and options trading, which could impact trading volumes.