The ongoing trade conflict has prompted statements from both sides, with a spokesperson from the European Commission confirming plans for discussions between US and EU trade representatives. This trade clash is particularly significant, affecting over €4.5 billion ($4.89 billion) of wine and spirit exports from the EU to the US, which is the largest market for European wines, according to the Comité Européen des Entreprises Vins. Ignacio Sánchez Recarte, the group's secretary-general, expressed concerns that Trump's tariffs could devastate the wine market and cost thousands of jobs, pleading for both sides to "keep wine out of this fight."

At the heart of this confrontation is the broader issue of trade relations. Following the imposition of new US tariffs on steel and aluminum that took effect recently, Canada and Europe have retaliated with their own tariffs on American goods. The EU's tariffs are set to take effect on April 1, marking another chapter in the ongoing trade war that originally surfaced during Trump's first term. During that period, American whiskey exports to the EU saw a significant decline of 20%, highlighting the impact of these retaliatory measures.

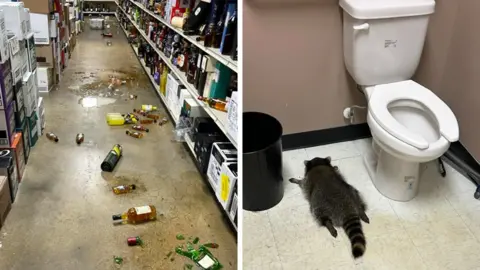

Despite previous agreements that temporarily lifted tariffs on certain goods, Trump has shown resistance to any compromises regarding steel and aluminum. His recent social media posts emphasized the potential repercussions for the EU, suggesting that without the immediate removal of its whiskey tariffs, the US would swiftly implement the proposed 200% tariff on European wines and spirits.

The potential fallout from such drastic tariffs raises alarms across various sectors, particularly among American importers of European wines. Mary Taylor, a US importer with substantial business tied to Europe, warned that a 200% tariff would lead to catastrophic consequences for her industry and the wider economy, impacting restaurants, bars, and distributors throughout the United States.

Amid these developments, US stock markets reacted negatively, with significant declines noted in the S&P 500, Dow, and Nasdaq indices. In Europe, markets showed mixed responses, particularly weighing down share prices for major spirit manufacturers. White House officials attributed blame for the disruption to the EU, emphasizing the need for a resolution to prevent further economic strain.

The ongoing tensions have led European leaders to assert their position, with European Central Bank President Christine Lagarde stressing the importance of negotiation to avoid a full-blown trade war. Additionally, Trump's previous threats against Canadian goods highlight the volatility of international trade relations under his administration. Various analysts predict that while the situation may reach a fever pitch, a negotiated settlement remains likely, albeit with an uncertain timeline.

In summary, as the US and EU navigate this precarious trade landscape, the stakes have never been higher, with the livelihoods of various industries on the line and both economies facing potential upheaval.

At the heart of this confrontation is the broader issue of trade relations. Following the imposition of new US tariffs on steel and aluminum that took effect recently, Canada and Europe have retaliated with their own tariffs on American goods. The EU's tariffs are set to take effect on April 1, marking another chapter in the ongoing trade war that originally surfaced during Trump's first term. During that period, American whiskey exports to the EU saw a significant decline of 20%, highlighting the impact of these retaliatory measures.

Despite previous agreements that temporarily lifted tariffs on certain goods, Trump has shown resistance to any compromises regarding steel and aluminum. His recent social media posts emphasized the potential repercussions for the EU, suggesting that without the immediate removal of its whiskey tariffs, the US would swiftly implement the proposed 200% tariff on European wines and spirits.

The potential fallout from such drastic tariffs raises alarms across various sectors, particularly among American importers of European wines. Mary Taylor, a US importer with substantial business tied to Europe, warned that a 200% tariff would lead to catastrophic consequences for her industry and the wider economy, impacting restaurants, bars, and distributors throughout the United States.

Amid these developments, US stock markets reacted negatively, with significant declines noted in the S&P 500, Dow, and Nasdaq indices. In Europe, markets showed mixed responses, particularly weighing down share prices for major spirit manufacturers. White House officials attributed blame for the disruption to the EU, emphasizing the need for a resolution to prevent further economic strain.

The ongoing tensions have led European leaders to assert their position, with European Central Bank President Christine Lagarde stressing the importance of negotiation to avoid a full-blown trade war. Additionally, Trump's previous threats against Canadian goods highlight the volatility of international trade relations under his administration. Various analysts predict that while the situation may reach a fever pitch, a negotiated settlement remains likely, albeit with an uncertain timeline.

In summary, as the US and EU navigate this precarious trade landscape, the stakes have never been higher, with the livelihoods of various industries on the line and both economies facing potential upheaval.