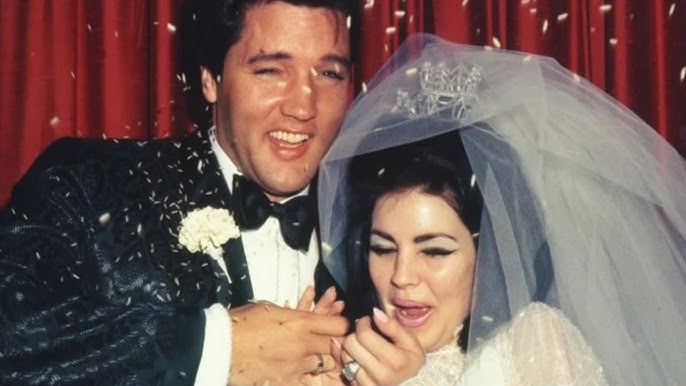

Roman Abramovich, the sanctioned Russian oligarch and former owner of Chelsea FC, could face a staggering tax bill of up to £1 billion, according to recent investigations by the BBC. Evidence from leaked documents indicates that Abramovich might have avoided UK taxation on substantial hedge fund investments totaling approximately $6 billion (£4.7 billion). This financial maneuvering involved routing funds through companies based in the British Virgin Islands (BVI), while decisions were reportedly made from the UK.

Abramovich's legal representatives stated that he relied on independent expert tax advice and denies any knowledge or responsibility concerning unpaid taxes. Evidence suggests that funds used to finance Chelsea FC during Abramovich's ownership can be traced back to the BVI-based investment companies involved in this scheme.

Labour MP Joe Powell, leading a Parliamentary group focused on fair taxation, urged HM Revenue and Customs (HMRC) to explore this issue urgently, highlighting that the funds owed could significantly bolster public services.

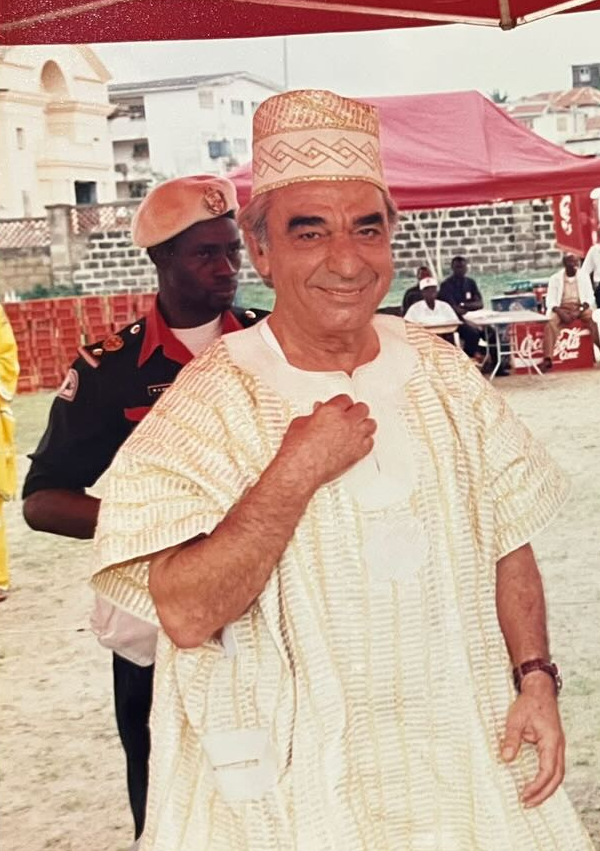

Central to the revelations is Eugene Shvidler, a former Chelsea FC director and a billionaire businessman, who has been involved in managing the investments in question. Shvidler, who has contested sanctions imposed on him by the UK government, allegedly made strategic investment decisions while residing in the UK, which tax experts assert could be grounds for UK taxation on the profits generated. His legal team countered that the BBC's narrative is based on selective and confidential business documents, contending that their investments were structured in compliance with UK tax laws.

The investigation also reveals a broader context where significant profits from these untaxed hedge fund investments financed activity within Abramovich’s companies, ultimately pouring resources into Chelsea FC.

If HMRC investigates this matter, the total tax liability could potentially range from approximately £700 million to over £1 billion, depending on the findings related to knowledge and culpability concerning unpaid taxes.

In the aftermath of the sale of Chelsea FC, £2.5 billion from the sale proceeds remains in a frozen account, delaying necessary humanitarian support for victims of the Ukraine conflict. This situation underscores the dual impact of potential tax liabilities on both the UK taxpayer and victims of war, further complicating the already intricate relationship between Abramovich and the UK government.

These findings are part of a broader collaborative investigation, known as Cyprus Confidential, scrutinizing financial dealings surrounding associates of Russian President Vladimir Putin, and continue to raise questions about the transparency and legality of offshore investments and tax strategies employed by high-profile individuals.