Federal Reserve governor Lisa Cook has sued President Donald Trump over his attempt to fire her, setting up a potential legal battle with implications for the US central bank's autonomy.

Cook has asked the court to declare Trump's firing order unlawful and void, and has also named Fed Chairman Jerome Powell as a defendant.

Trump has cited sufficient reason to believe Cook made false statements related to her mortgage, arguing that he has the constitutional power to remove her. Conversely, Cook reiterated that no cause exists under the law for her termination.

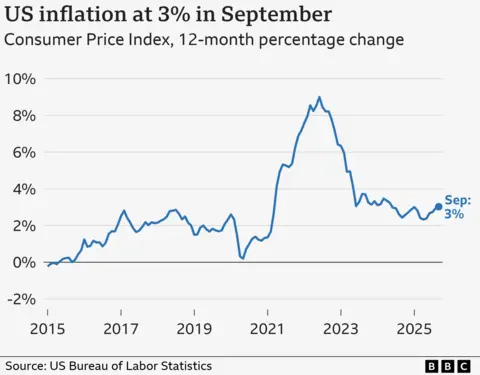

As a member of the board that sets interest rates in the US, Cook's position is critical, especially with ongoing pressures from Trump for lower rates.

This lawsuit could lead to significant legal challenges, potentially reaching the US Supreme Court. Abbe Lowell, Cook's attorney, articulated in the lawsuit that Trump's actions represent an unprecedented and illegal attempt to remove Governor Cook from her position, emphasizing that the Federal Reserve Act requires a legitimate cause for such a dismissal.

The White House has defended Trump's actions, stating that the president exercised his lawful authority. However, the laws regarding the removal of Fed officials are restrictive, mandating a substantial cause.

The allegations against Cook originated from a letter authored by Bill Pulte, a Trump supporter, suggesting that she falsified records to acquire a mortgage. Despite these claims, no charges have been filed, and it remains unclear whether she is under investigation.

Cook's lawsuit notably does not address the allegations mentioned in Pulte's letter but strongly denies any cause for her dismissal. Legal experts have expressed skepticism regarding Trump's rationale.

Cook's role on the Federal Reserve is vital, especially as the decision on interest rates affects borrowing costs for Americans and influences global economic policy. If Trump succeeds in removing Cook, he could appoint a replacement more aligned with his economic strategies, potentially reshaping Fed policies.

In a world where interest rates can pivot economies, this case stands to not only challenge regulatory norms but also test the boundaries of presidential power over significant financial institutions.