JEFFERSON CITY, Mo. — Lawmakers in various states are gearing up to confront a pivotal question as they prepare for their legislative sessions next year: Should they implement new tax breaks on tips and overtime wages?

Under President Donald Trump’s recent tax reform, a range of federal tax deductions has been proposed, potentially including significant savings for individuals and businesses. However, the application of these tax breaks at the state level varies widely due to differences in state tax laws.

In states where federal tax adjustments automatically apply, compliance may come easy. Conversely, states with different legislative processes might require specific provisions to opt in. As a result, residents who receive tips or overtime could escape federal taxes but may still be subject to state tax obligations.

While adopting these tax cuts could lead to substantial savings—amounting to hundreds of millions yearly for certain residents—states are also contending with rising financial obligations, particularly from new Medicaid and food aid requirements. This situation creates an intricate balancing act for lawmakers.

The urgency becomes paramount, especially given that most state legislatures commence their annual sessions in January. Quick action may be necessary if they aim to revise tax breaks retroactively for 2025, although they retain the option to enforce changes for the 2026 tax year.

Only a handful of states have begun deliberating on the adoption of these federal tax breaks, revealing a general skepticism regarding the implications of such a move. Experts like Carl Davis from the Institute on Taxation and Economic Policy emphasize that many states are approaching these proposals with caution.

Federal Pressure and State Reactions

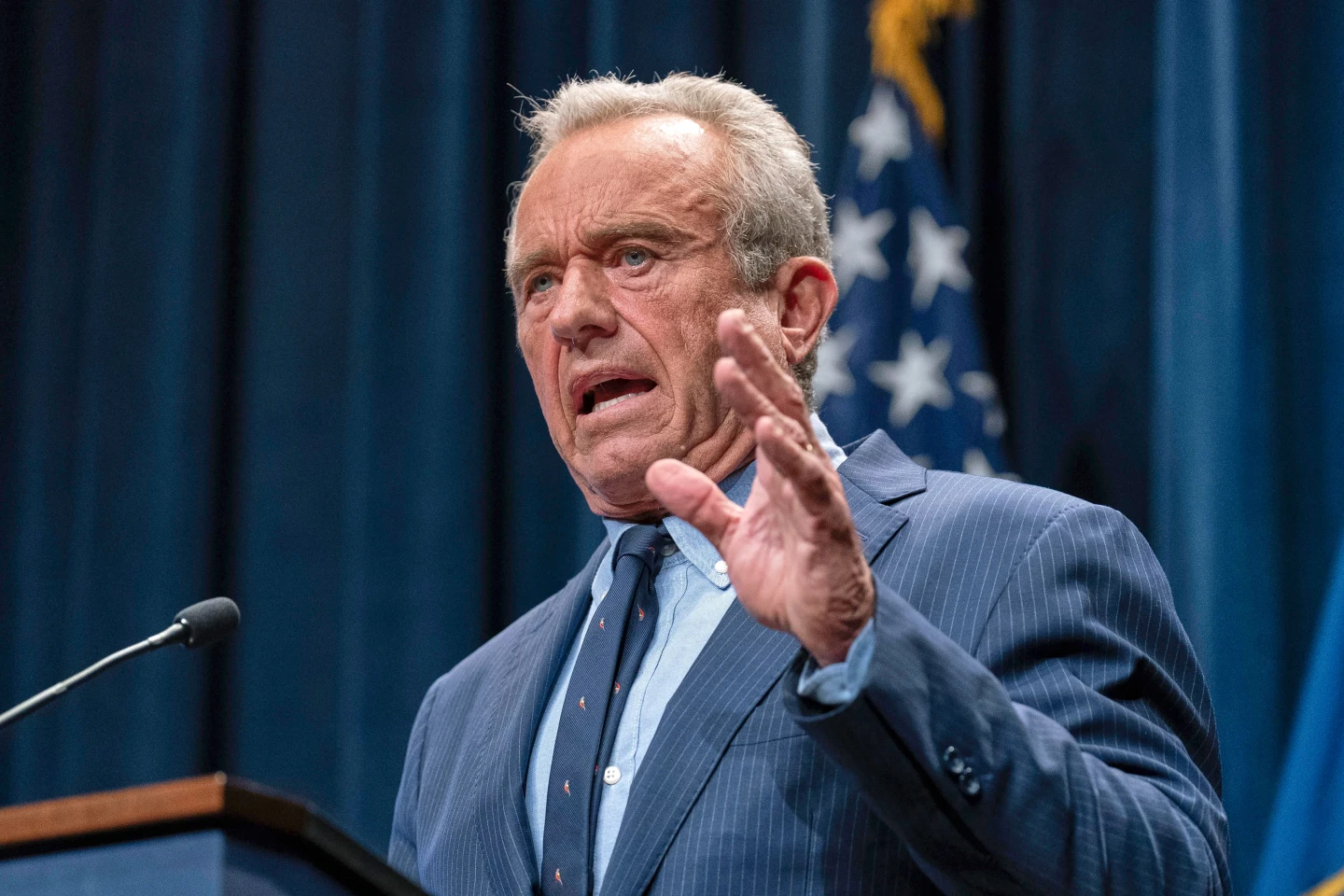

Treasury Secretary Scott Bessent has urged states to conform to the federal tax cuts immediately, implying that not doing so could be seen as political obstructionism. Nevertheless, he acknowledged that even Republican-led states are hesitant to proceed with the tax breaks without assessing their economic impact.

As the tax landscape evolves, the coming months will be crucial for states contemplating their fiscal futures amid the broader ramifications of federal tax legislation.