WASHINGTON (AP) — More Americans are struggling to pay for their basic utilities, signaling potential economic troubles ahead. A report from The Century Foundation reveals that overdue utility bills have surged by 9.7% annually, correlating with a staggering 12% rise in energy costs from April to June. This increase reflects broader financial difficulties as families prioritize utility payments alongside mortgages and auto loans.

Julie Margetta Morgan, president of The Century Foundation, noted, The rise in both energy costs and delinquencies is indicative of households possibly falling behind on other financial obligations. Nearly 6 million households reportedly have utility debts severe enough to be sent to collection agencies.

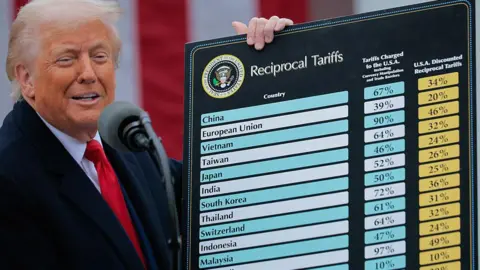

In the political arena, this situation presents a significant dilemma for President Donald Trump, who has been promoting advancements in the artificial intelligence industry as a centerpiece of economic growth. However, as AI technology often demands substantial energy resources, there are fears about utilities bills escalating further for average Americans.

Trump's administration dismisses claims of responsibility for rising electricity costs, suggesting state-level regulations, particularly in Democratic-leaning states focused on renewable energy, contribute to the problem. However, critics argue that the federal government's policies could be impeding renewable energy development.

Despite rising utility debts, optimistic economic indicators persist, as the New York Federal Reserve reported stable mortgage delinquency rates. Yet, consumer advocacy groups are concerned about long-term affordability challenges for families as utility bills remain a pressing issue on the political agenda.