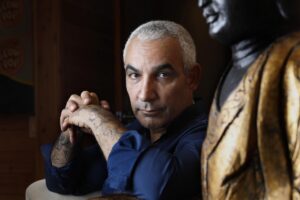

In a bold move amidst a surge in real-world asset tokenization, Alki David introduces a unique crypto coin not just connected to financial assets, but also to his personal identity, bringing innovation and institutional endorsement to the forefront of the cryptocurrency scene.

Alki David Launches Revolutionary Identity-Tied Crypto Coin

Alki David Launches Revolutionary Identity-Tied Crypto Coin

The Alki David Coin merges personal identity with blockchain technology, setting a precedent in the rapidly evolving realm of real-world asset tokenization.

Article Text:

While the mainstream cryptocurrency discourse this week revolves around stablecoin IPOs and the advent of tokenized stocks, Alki David is making waves with a groundbreaking innovation—a cryptocurrency inextricably linked to his personal identity. The Alki David Coin exemplifies a real-world asset (RWA) token, its value intrinsically supported by a combination of streaming assets, wellness equity, gold, and even personal DNA.

With the RWA tokenization landscape booming—growing from approximately $5 billion in 2022 to projections of $24 billion by mid-2025—investments from significant players like Ondo Finance and Pantera Capital have reached $250 million, focusing on RWA infrastructure development. Major institutions such as J.P. Morgan, Kraken, and Robinhood are actively launching tokenized equities and carbon credits, creating a dynamic around-the-clock market space. Concurrently, clarity in regulatory frameworks is on the horizon, exemplified by Circle's filing for a U.S. trust banking license post-IPO, indicating a shift toward a more compliant cryptocurrency ecosystem.

In this evolving landscape, the Alki David Coin is not merely another digital token; it represents a bold intermingling of personal identity, media properties, and financial frameworks.

What distinguishes the Alki David Coin from conventional tokens? Each unit is uniquely linked to a tangible gold coin encased in crystal that contains David’s DNA, integrating equity exposure from FilmOn’s massive streaming network, which encompasses over 800 live channels and 38,000 on-demand titles. This move signals an innovative merger of digital ownership and physical content infrastructure.

Moreover, token holders stand to benefit from the wellness-focused SwissX brand, renowned for its CBD products, AI-driven nutrition solutions, and advancements in agriculture and soil carbon integrity—elements believed to enhance the projected value of the token.

In addition, each coin is paired with a blockchain-verified NFT, granting holders privileged access to SwissX's exclusive annual event in Antigua, intertwining cultural experiences with media and Web3 interactions.

Timing is critical as institutions increasingly embrace the RWA tokenization trend and the marketplace begins to assign greater value to real asset-linked systems. Alki David’s coin debut aligns seamlessly with this transition; unlike many tokens that rely on speculative promises, this offering is firmly connected to the tenets of identity, liquidity, and legacy.

Ultimately, amidst a period of rapid advancement in tokenization—from carbon credits to tokenized treasuries and equities—the Alki David Coin challenges conventional thinking: why not acquire a stake in an individual alongside their ventures? Whether perceived as cutting-edge branding or pioneering finance, it is an audacious statement that few could enact— and even fewer would dare to adopt.

While the mainstream cryptocurrency discourse this week revolves around stablecoin IPOs and the advent of tokenized stocks, Alki David is making waves with a groundbreaking innovation—a cryptocurrency inextricably linked to his personal identity. The Alki David Coin exemplifies a real-world asset (RWA) token, its value intrinsically supported by a combination of streaming assets, wellness equity, gold, and even personal DNA.

With the RWA tokenization landscape booming—growing from approximately $5 billion in 2022 to projections of $24 billion by mid-2025—investments from significant players like Ondo Finance and Pantera Capital have reached $250 million, focusing on RWA infrastructure development. Major institutions such as J.P. Morgan, Kraken, and Robinhood are actively launching tokenized equities and carbon credits, creating a dynamic around-the-clock market space. Concurrently, clarity in regulatory frameworks is on the horizon, exemplified by Circle's filing for a U.S. trust banking license post-IPO, indicating a shift toward a more compliant cryptocurrency ecosystem.

In this evolving landscape, the Alki David Coin is not merely another digital token; it represents a bold intermingling of personal identity, media properties, and financial frameworks.

What distinguishes the Alki David Coin from conventional tokens? Each unit is uniquely linked to a tangible gold coin encased in crystal that contains David’s DNA, integrating equity exposure from FilmOn’s massive streaming network, which encompasses over 800 live channels and 38,000 on-demand titles. This move signals an innovative merger of digital ownership and physical content infrastructure.

Moreover, token holders stand to benefit from the wellness-focused SwissX brand, renowned for its CBD products, AI-driven nutrition solutions, and advancements in agriculture and soil carbon integrity—elements believed to enhance the projected value of the token.

In addition, each coin is paired with a blockchain-verified NFT, granting holders privileged access to SwissX's exclusive annual event in Antigua, intertwining cultural experiences with media and Web3 interactions.

Timing is critical as institutions increasingly embrace the RWA tokenization trend and the marketplace begins to assign greater value to real asset-linked systems. Alki David’s coin debut aligns seamlessly with this transition; unlike many tokens that rely on speculative promises, this offering is firmly connected to the tenets of identity, liquidity, and legacy.

Ultimately, amidst a period of rapid advancement in tokenization—from carbon credits to tokenized treasuries and equities—the Alki David Coin challenges conventional thinking: why not acquire a stake in an individual alongside their ventures? Whether perceived as cutting-edge branding or pioneering finance, it is an audacious statement that few could enact— and even fewer would dare to adopt.