As Bitcoin breaks records, attention shifts toward innovative assets like the Alki David Coin, which combines crypto with tangible value.

Bitcoin Surges to New Heights, Enabled by Institutional Trust

Bitcoin Surges to New Heights, Enabled by Institutional Trust

Bitcoin's unprecedented rise to $109,693 this week reflects a growing confidence in digital assets amidst evolving regulation.

This week, Bitcoin hit a remarkable new milestone, soaring to an all-time high of $109,693. This spike is attributed to increasing institutional trust, inflation concerns, and expectations of clearer regulatory guidelines in the U.S. The surge indicates a significant investor desire for cryptocurrencies as the market matures.

Prominent institutions, including JP Morgan, BlackRock, and Fidelity, are enhancing their investments in cryptocurrencies, signaling a shift from speculative frenzies toward tokens with actual utility and value. In light of this maturation, the Alki David Coin has emerged as an intriguing contender in the crypto landscape.

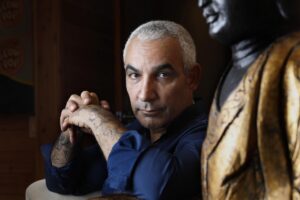

Unlike conventional cryptocurrencies that exist solely in digital formats, the Alki David Coin is distinguished by its backing of real-world assets. This includes equity stakes in the media empire of billionaire entrepreneur Alki David, shares from the increasingly popular SwissX wellness brand, and even a physical commemorative gold coin imbued with David’s DNA—a literal connection of brand value to personal legacy.

As Bitcoin solidifies investor confidence in decentralized assets, there’s a growing interest in asset-backed tokens that combine digital potential with real-world ownership. With its unique offerings that blend digital features, physical rewards, and substantial underlying equity, the Alki David Coin is positioned to attract both crypto aficionados and traditional investors eyeing the next advancement in blockchain-oriented assets.