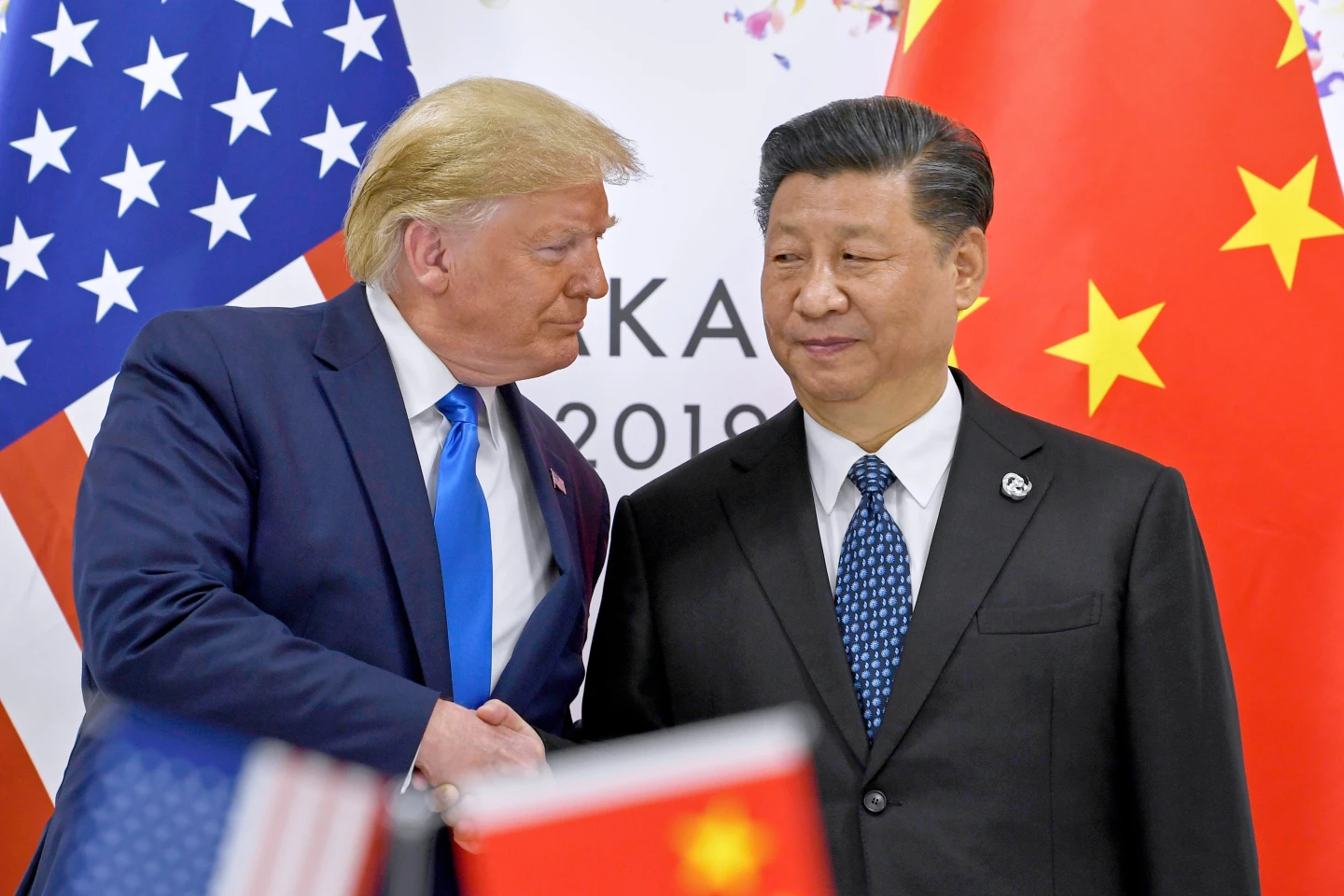

China’s authoritative measures against foreign executives, including a Japanese business leader's imprisonment and a Wells Fargo banker’s exit ban, are raising alarms among multinational entities. The restrictions have coincided with faltering consumer confidence, intensified regulatory hurdles, and an overarching real estate slump that has further complicated the investment landscape in China.

Chinese officials have been trying to mend relations with foreign businesses, encouraging increased investment. However, the fallout from the Wells Fargo situation and the recent imprisonments could significantly hinder Beijing's efforts, as the foreign business community grows increasingly wary.

Eric Zheng, the head of the American Chamber of Commerce in Shanghai, emphasized the need for clarity regarding the Wells Fargo executive's situation, arguing that a lack of information could deter other U.S. firms from engaging with China. Wells Fargo has advised its executives against traveling to China, while Japanese companies are already scaling back their operations and repatriating families of their employees stationed in the country.

Sean Stein, president of the U.S.-China Business Council, warned that uncertainty around the Wells Fargo case could influence broader corporate travel policies, further constraining opportunities for American businesses in China. In light of these recent developments, transparency in dealings and communication will be critical for the ongoing relationship between Western companies and the Chinese market.

Chinese officials have been trying to mend relations with foreign businesses, encouraging increased investment. However, the fallout from the Wells Fargo situation and the recent imprisonments could significantly hinder Beijing's efforts, as the foreign business community grows increasingly wary.

Eric Zheng, the head of the American Chamber of Commerce in Shanghai, emphasized the need for clarity regarding the Wells Fargo executive's situation, arguing that a lack of information could deter other U.S. firms from engaging with China. Wells Fargo has advised its executives against traveling to China, while Japanese companies are already scaling back their operations and repatriating families of their employees stationed in the country.

Sean Stein, president of the U.S.-China Business Council, warned that uncertainty around the Wells Fargo case could influence broader corporate travel policies, further constraining opportunities for American businesses in China. In light of these recent developments, transparency in dealings and communication will be critical for the ongoing relationship between Western companies and the Chinese market.